Breaking News

Akur8 publishes new report “Pricing Teams in a Changing Word”

Rapid transformations occurring today in the actuarial field are affecting both junior and senior pricing experts. Dynamic trends, including the surge in data volume and diversity facilitated by technological advancements are creating a new definition of the ideal candidate and employer for pricing professionals. Akur8’s new report outlines the evolving backgrounds of actuarial and pricing professionals, and gives an overview of the main trends and role evolutions within their careers.

The evolution of the actuarial field and its impact on insurance pricing roles

Dynamic trends have triggered a paradigm shift within the actuarial field, with today’s pricing professionals facing a crossroads between traditional expertise and digital proficiency. As competing academic paths are emerging, actuaries are not the exclusive targets for pricing roles anymore. However, traditional actuarial skills such as analytical and industry expertise are still highly valuable for insurance companies.

Defining actuarial talent within pricing roles

The supply of emerging actuaries in today’s market are not meeting the demand, and the gap is only increasing. In addition, as job prospects in related fields such as data science rise, new doors have opened for actuarial hiring managers. The entrance into actuarial roles has expanded as the importance of non-traditional methods increase, causing data scientists new access to enter the industry. Therefore, non-certified pricing experts can use their skills to meet new technological requirements within the field. This route offers a quicker, if not less recognized path, compared to the traditional decade-long process required to attain actuarial certification.

Changes in actuarial studies and its effect on junior actuaries

Due to the evolution in the curriculums and desired skills of actuarial professionals, recent graduates and junior actuaries are increasingly familiar with the challenges related to a surge in data volume and diversity facilitated by technological advancements. Extracting insights from a variety of data sources, and gaining the ability to understand how to integrate cutting edge technologies such as AI and machine learning into actuarial practices, is now a key skill for pricing experts. Although the rise of data science has posed challenges for actuaries, it has also allowed for new opportunities: actuarial education is evolving to match industry demands by emphasizing machine learning and data science in actuarial studies.

Who is the “ideal employer” for today’s pricing experts?

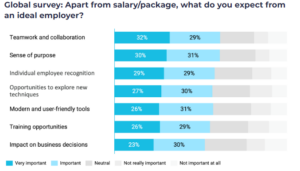

Due to the shortage of talent within the actuarial field, retention has become a key focus for employers. Because of this, it is vital for employers to understand the viewpoint of emerging actuaries and determine how to become the “ideal employer” within the industry. They must adapt their strategies to attract and retain junior actuaries and now focus on reputation, collaboration and sense of purpose, as well as opportunities to work with modern, efficient tools and test new techniques.

Companies In This Post

- Genpact Launches New Agentic Solution to Reinvent Insurance Buying Read more

- Home Claims Insights from LexisNexis Risk Solutions Helps Empower U.S. Property Insurance Executives Read more

- Community Health Options Selects Gradient AI to Accelerate Group Health Underwriting and Renewals Read more

- Zego Reports Strong Results and Launches New Consumer Insurance Product Read more

- Duck Creek Technologies Named a Leader Once Again in 2025 Gartner® Magic Quadrant™ for SaaS P&C Insurance Core Platforms, North America Read more